Digital Disruption in Telecom

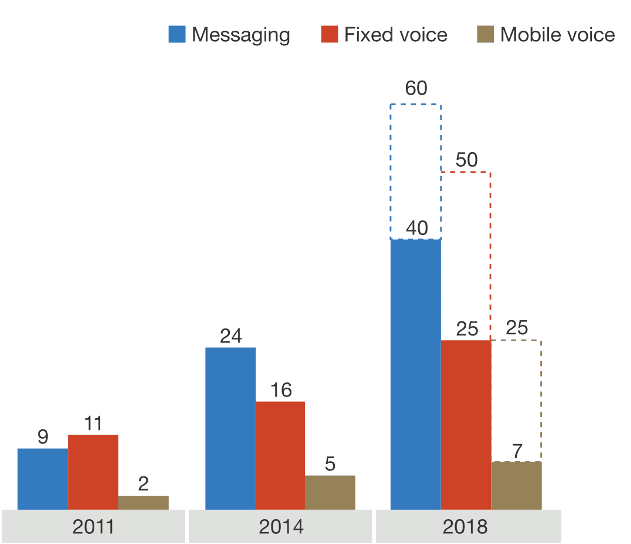

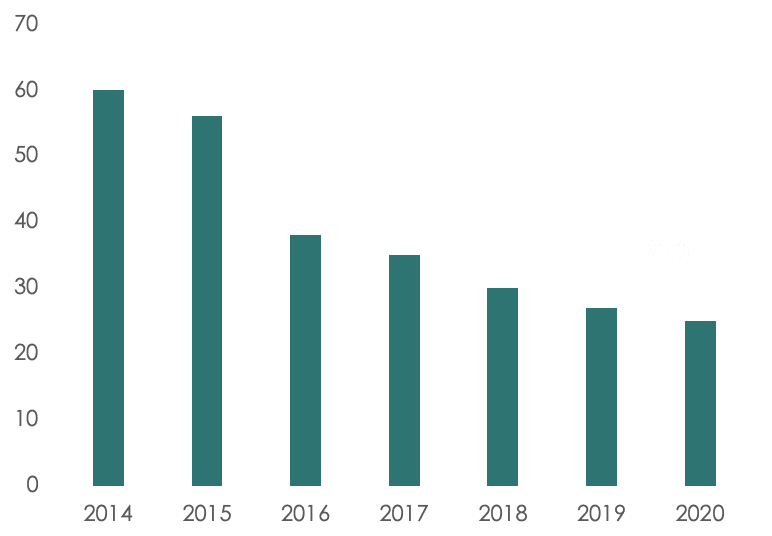

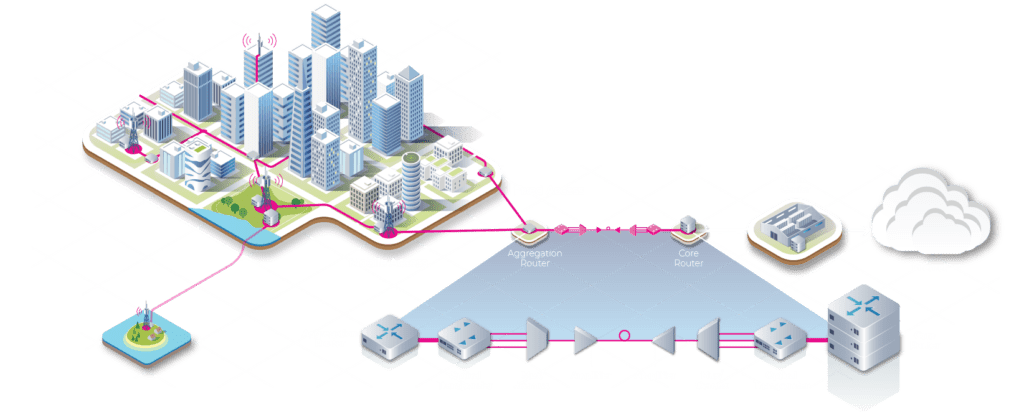

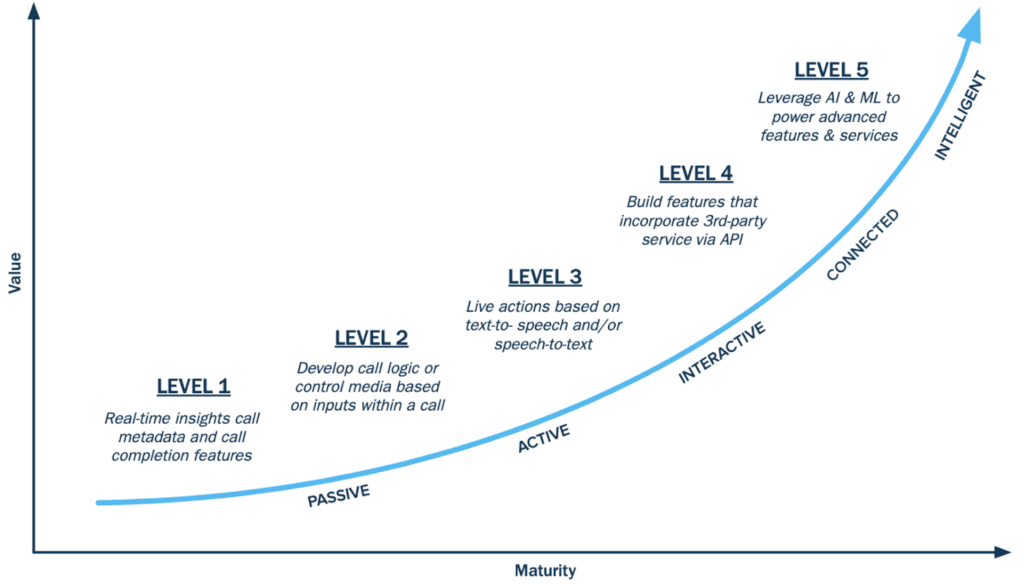

Like so many other industries before, telecom now faces a moment of reckoning as operators come under increasing pressure from new digital-native entrants and evolving consumer preferences. With revenues continuing to decline and digital disruption on the horizon, many MNOs are left with a stark choice: innovate fast or be displaced. Read on to learn about how key digital trends are transforming telecom and reshaping the technology landscape.